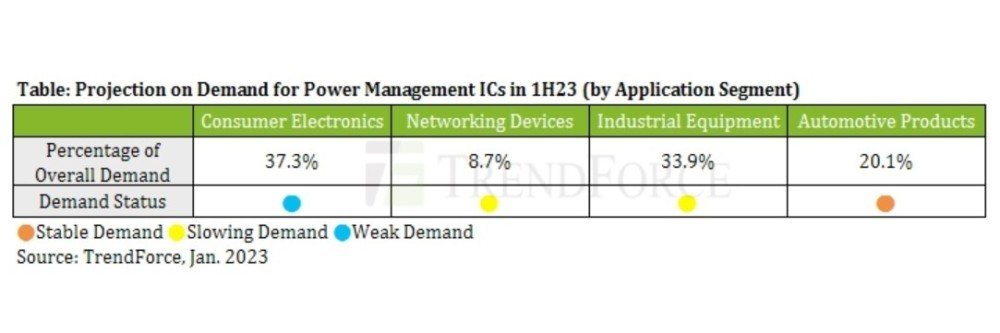

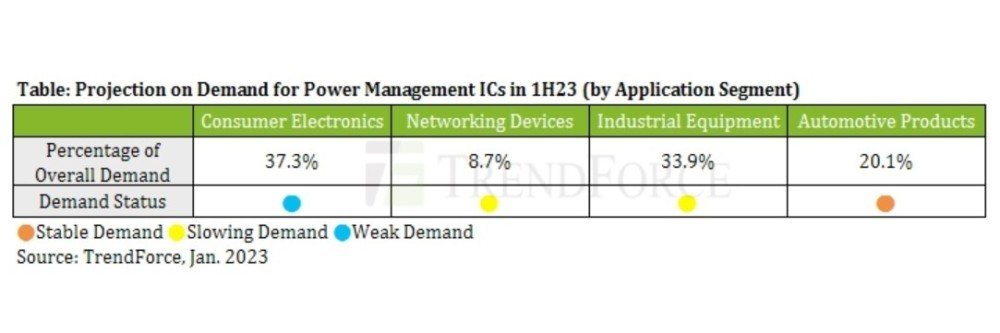

Texas Instruments (TI), a leading supplier of power management ICs, will start up additional capacity at its production sites RFAB2 and LFAB at the same time. In light of this, TrendForce expects global power management IC production capacity to grow by 4.7% year-on-year in the first quarter. In the power management IC market, declining demand from consumer electronics, networking equipment and industrial equipment continues to put downward pressure on prices. As a result, power management IC order quotes are expected to decline by 5-10% YoY in the first quarter. Con versely, demand for automotive products remains stable due to the trend towards vehicle electrification. Although the broader economic weakness is creating uncertainty in the automotive market as a whole, prices are not expected to fluctuate significantly as buyers and sellers of automotive products have mostly established long-term partnerships. As a result, demand from the automotive market will be the only major driver of power management IC sales.

Major IDMs control 63% of the power management IC market

The suppliers of power management ICs are diverse and include major international IDMs as well as fabless IC design houses. Suppliers that are IDMs include Texas Instruments, ADI, Infineon, Renesas, ON Semiconductor, STMicroelectronics and NXP. Suppliers of fabless IC design companies include Qualcomm, MPS, MediaTek, Anpec, GMT, Leadtrend, Weltrend, Silergy, BPS and SG Micro.

Together, IDMs control 63% of the global power management IC market in terms of market share of shipments. Of these, Texas Instruments leads the way with a 22% global market share. Texas Instruments' strengths are its wide product range, consistent product quality and sufficient production capacity. As a result, it has a huge impact on the global power management IC market. Looking at the overall price trend of power management ICs in 2022, IDM is able to further push up ASPs to cope with rising inflation. C onversely, fabless IC design companies are the first to see a weakening trend in their offers.

TrendForce notes that power management IC prices for consumer electronics (such as notebooks, tablets, TVs and smartphones) start to fall in Q3 2022, with a 3-10% YoY decline. In the fourth quarter of 2022, prices for various consumer power management ICs (e.g. those related to AC-DC, DC-DC, LDO, buck, boost, PWM and battery chargers) declined by another 5-10 percent sequentially. In addition to this development, demand for power management ICs for networking equipment and most industrial equipment has also started to weaken. The only applications that still showed steady demand were a very few specific types of industrial equipment (e.g. military hardware) and automotive products. At that time, order visibility for these applications had extended into the second quarter of the year, and there was no apparent attempt to drive sales of the relevant power management ICs through price reductions.

However, TrendForce also noted that IDMs together held more than 83% of the market share for power management ICs embedded in industrial equipment and automotive products. Most fabless IC design companies are still struggling to penetrate these specific market segments, but their efforts have been aggressive as overall demand for consumer electronics remains sluggish. Currently, fabless IC design houses are working to get their new automotive and industrial power management ICs certified as soon as possible.

In terms of lead times for power management IC orders, the latest TrendForce survey found that the average lead time for fabless IC design houses is currently 12-28 weeks. In addition, the existing stock of certain models of power management ICs is so large that fabless IC design houses can start shipping new orders as soon as they are received. As for IDMs, their lead times are still mostly longer. For power management ICs belonging to non-automotive applications, the lead time for IDMs is 20-40 weeks. For power management ICs belonging to automotive applications, the lead time for IDMs is more than 32 weeks. Overall, orders for automotive power management ICs are still in a state of distribution: there are fewer suppliers, and chip manufacturing, module assembly and qualification are lengthy.

How many chips does a car need?

How many chips does a car need?

Position and Function of Main Automotive Sensors

Position and Function of Main Automotive Sensors

Chip: The increasingly intelligent electronic brain

Chip: The increasingly intelligent electronic brain

LDA100 Optocoupler: Outstanding Performance, Wide Applications

LDA100 Optocoupler: Outstanding Performance, Wide Applications