Storage majors cut capital expenditure for next year

Views : 12

Update time : 2022-10-17 13:57:29

Since the second quarter of this year, DRAM memory and NAND flash memory prices have fallen rapidly and have still not stopped falling in the fourth quarter, with news even suggesting that NAND flash memory will fall below the cost of manufacturing. This has led to huge fluctuations in the performance of storage majors Samsung, SK Hynix, Micron and Armor Man, with manufacturers offering emergency measures such as cutting production or slowing investment in response to market changes. But Samsung may intend to go the other way.

Fourth quarter market continues downward.Memory has always been known as a barometer of the semiconductor industry, and the industry is currently in the midst of a sudden drop in demand and falling prices. Data shows that DRAM memory shipments in the third quarter were down sequentially, with end buyers delaying purchases due to a significant drop in demand. In order to increase market share, DRAM suppliers are already "combining the third and fourth quarters" or "negotiating volume before negotiating price". DRAM prices will fall by 13% to 18% in the fourth quarter.

NAND flash memory prices have also seen a rapid reversal, with NAND wafer prices dropping by more than 30% in the third quarter, and in the fourth quarter, NAND flash memory prices will fall by 15% to 20%. We believe that the oversupply trend in the NAND market may continue until the second half of 2023 before the price decline has a chance to converge quarter by quarter.

On October 7, Samsung Electronics released its preliminary third quarter financial results. According to the report, Samsung Electronics' third quarter revenue was 76 trillion won (US$53.8 billion) and operating profit was 10.8 trillion won (US$7.7 billion), down 31.7% year-on-year. On October 1, Micron Technology released its fourth quarter earnings for fiscal 2022, with operating income of US$6.64 billion, down about 20% year-on-year, and net profit of US$1.492 billion, down a whopping 45% year-on-year.

Samsung or counter-cyclical operation?

In response to the continued downturn in the storage chip market, Micron, Armor Man, SK Hynix and other storage chip majors have taken production cuts and scaled back capital expenditures for next year. Micron Technology CEO Sanjay Mehrotra recently pointed out that in response to the decline in demand, the company is taking appropriate action, including slowing down production and cutting capital expenditures, capital expenditures for fiscal year 2023 will be reduced by about $ 8 billion, a 50% reduction in spending on wafer fab equipment. Armor Man also issued a statement saying that it will adjust production at its Yokkaichi and Kitakami NAND flash memory fabs in Japan, and that wafer production will be reduced by about 30 percent from October, and that Armor Man will continue to review and adjust operations as needed. In this regard, some industry insiders pointed out that Samsung Electronics, SK Hynix and Micron still have DRAM profits to balance, the tight funding situation NAND plants will bear the brunt.

However, it is worth noting that Samsung Electronics, which has always had a tradition of counter-cyclical operations, may go the other way this time. Sources said that Han Jin-man, head of global marketing for Samsung's storage business, revealed at the recent Samsung Technology Day annual conference that it would not consider cutting production of memory chips. He said that Samsung's basic position is that it should not artificially reduce production and seeks to ensure that there is neither a long-term shortage nor a surplus of chip supply.

Samsung Electronics has carried out three counter-cyclical operations in the memory chip market in 1980, 1990 and 2007. With the storage market facing an industry-wide down cycle, Samsung maintained or even increased production, while increasing its research and development efforts. Under such operations, Samsung achieved a leading position in technology and market.

NAND consolidation could happen。Although Samsung has not made a clear statement, it is expected to accelerate the balance of supply and demand in the storage market under the reduction of capital expenditure by Micron, Sk Hynix, Armor Man and other companies. According to a report by Tiburon Consulting, the full-year 2023 DRAM oversupply ratio will converge to less than 10% from the original estimate of 11.6%, helping to improve the rapidly deteriorating inventory pressure. Pan Jiancheng also believes that observing the recent adjustment practices of original manufacturers shows that the current NAND flash market conditions are almost near the bottom, with all NAND original manufacturers facing serious pressure to lose money and reduce production. In other words, the NAND market price is likely to have fallen below the manufacturing cost, or even below the cash cost, and it is expected that the chances and magnitude of further decline will gradually shrink.

However, Lin Da Xiang believes that the drastic change in the market will have an important impact on the industry landscape. Unlike DRAM, which is already a trio of giants, the NAND sector is still dominated by Samsung, Armor Man/Western Data, SK Group and Micron. The fight for market share will also be more intense when the market is down. Semiconductors are a high capital investment industry, and the competition for market share is whether the cash flow of each company is sufficient and whether the cost structure is low enough. As the price decline accelerates, the first to face a drop in market price below the cash cost will face difficulties in their operations, and if they choose to withdraw from the competition, a merger may follow.

How many chips does a car need?

How many chips does a car need?

Position and Function of Main Automotive Sensors

Position and Function of Main Automotive Sensors

Chip: The increasingly intelligent electronic brain

Chip: The increasingly intelligent electronic brain

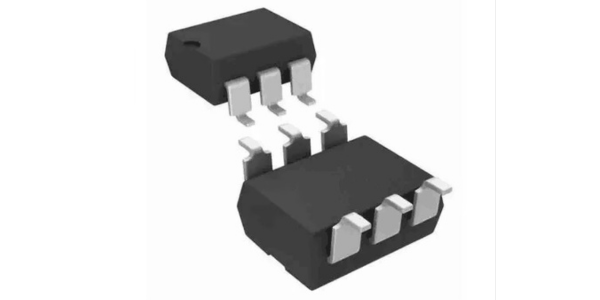

LDA100 Optocoupler: Outstanding Performance, Wide Applications

LDA100 Optocoupler: Outstanding Performance, Wide Applications