Texas Instruments Q3 net income up 18% year-over-year Q4 guidance falls short of expectations

Views : 11

Update time : 2022-10-28 11:40:27

Texas Instruments has announced its financial results for the third quarter of fiscal year 2022. According to the results, Texas Instruments reported Q3 revenue of US$5.241 billion, up 13 percent year-over-year, better than analysts' expectations of US$5.14 billion and the seventh consecutive quarter of double-digit percentage revenue growth; net income of US$2.295 billion, up 18 percent year-over-year; and diluted earnings per share of US$2.47, better than analysts' expectations of US$2.39 and US$2.07 in the same period last year.

However, Texas Instruments expects fourth-quarter revenue of $4.4 billion to $4.8 billion, below analysts' expectations of $4.93 billion; fourth-quarter earnings per share are expected to be $1.83 to $2.11, also below analysts' expectations of $2.22. As a result of the news, Texas Instruments shares fell 5.47 percent to $153.29 after hours on Tuesday.

Texas Instruments has the largest customer list in the semiconductor industry, with automotive and industrial machinery manufacturers contributing more than 60 percent of the company's revenue. Today, some industrial manufacturer customers are slowing down their orders, as are computer and mobile phone makers. But Texas Instruments also said that demand in the automotive sector remains strong.

Texas Instruments CEO Rich Templeton said, "In the third quarter, we experienced the expected weakness in demand in the consumer electronics segment, as well as expanding weakness in demand across the industrial segment." The company said that overall, the order situation gradually deteriorated in the third quarter, with an increase in cancellations.

Notably, in addition to Texas Instruments, many large companies in the semiconductor industry, including Samsung Electronics (208.25, 0.00, 0.00%), Intel (27.41, 0.23, 0.85%) (INTC.US) and Nvidia (NVDA.US), have warned that demand is falling sharply.So far in 2022, the Philadelphia Semiconductor Index has fallen by a cumulative total of about 39 per cent. However, the index had risen for seven consecutive sessions as of Tuesday's close in the US, suggesting that investors believe the sector has bottomed out, which is what they had been hoping to see. Shares of Texas Instruments have accumulated a decline of about 12 per cent through 2022, but have outperformed most peers.

As one of the pioneers in the chip industry, Texas Instruments is the largest manufacturer of analog and embedded processing chips, which are used in a variety of products such as factory equipment and space hardware and generally require less manufacturing processes than Intel processors or other digital products. This focus on such chips has made Texas Instruments one of the most profitable companies in the industry, with cash used for dividends and share buybacks.

In addition to revenue and earnings per share, Texas Instruments' management generally refuses to make predictions about future demand for electronics. They believe that while the semiconductor industry will always experience volatility, its chips have enduring value. Unlike digital semiconductors such as microprocessors, Texas Instruments' products take several years to become obsolete, which means that building up inventory when demand is weak is not as dangerous as it is for other chip makers.

Texas Instruments' inventory stood at $2.4 billion at the end of the third quarter, up from $1.86 billion a year earlier. Rafael Lizardi, the company's chief financial officer, said that despite the increase in inventory, it was still below the company's target. The company could add as much as $1 billion further to its inventory.

Texas Instruments makes about 80 per cent of its chips in its own factories, and the company is expanding that. The company says this will lead to higher levels of capital expenditure in the coming years. As a result, some analysts are concerned that these expenditures will limit the company's stock buyback budget.

How many chips does a car need?

How many chips does a car need?

Position and Function of Main Automotive Sensors

Position and Function of Main Automotive Sensors

Chip: The increasingly intelligent electronic brain

Chip: The increasingly intelligent electronic brain

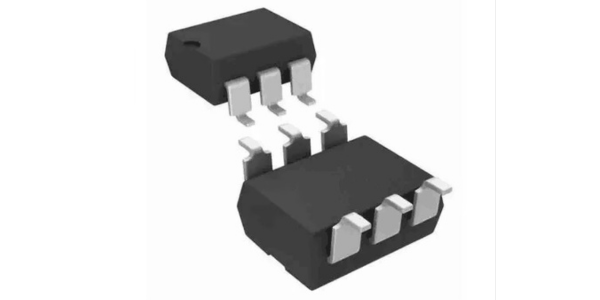

LDA100 Optocoupler: Outstanding Performance, Wide Applications

LDA100 Optocoupler: Outstanding Performance, Wide Applications