UMC: Q4 shipments may fall 10% YoY, lowers full-year capex to $3 billion

Views : 15

Update time : 2022-10-29 10:20:29

UMC, a leading foundry, held a press conference today and announced its third quarter 2022 results, which exceeded expectations. However, UMC expects to be challenged by the downward market trend in the fourth quarter and has lowered its 2022 capital expenditure to US$3 billion from US$3.95 billion expected in the previous quarter.

Specifically, revenue for the third quarter of 2022 was NT$75.39 billion, up 4.6% sequentially from NT$72.06 billion in the second quarter and up 34.9% from NT$55.91 billion in the same period of 2021. Overall gross profit margin reached 47.3% in the third quarter, with net profit attributable to the parent at NT$27 billion and EPS at NT$2.19 per share, another record high.

Consolidated revenue for the first three quarters of 2022 was NT$210.87 billion, a 37.01% increase over the same period in 2021 and a record high gross margin of 45.83%, both of which were the highest in the last 22 years. Net profit after tax was NT$68.131 billion, a significant increase of 71.05% over the same period in 2021, and EPS was NT$5.54 per share.

UMC said at its previous second quarter conference that it expects shipments to remain flat and capacity utilization to remain at 100% for the third quarter, but gross margins to drop to approximately 44% to 46%.

Judging from the announced third quarter results, both revenue and gross margin performance exceeded expectations. UMC's General Manager, Mr. Wang Shih, said that operating results remained solid in the third quarter, mainly benefiting from the optimisation of product mix and exchange rate factors. Despite the weak market demand trend in some consumer terminals, stable demand for specific wireless communication products continued to drive revenue growth in the 22/28nm process in the quarter, coupled with higher average selling prices for some products, the revenue share rose to 25% and overall capacity utilization was also at full capacity.

In addition, as smartphones and other terminal devices gradually adopt OLED panels, UMC believes that its leading position in OLED display driver chips will continue to drive growth in 22/28nm. UMC will continue to seek more cooperation opportunities with existing and potential automotive chip customers to sustain UMC's future growth momentum.

Mr. Wang further noted that looking ahead to the fourth quarter, the company is expected to face weak demand due to inflation and the Russian-Ukrainian conflict. The impact of inventory adjustments in the semiconductor industry cannot be avoided, but we will work closely with our customers to respond to market changes. At the same time, we will continue to focus on differentiated processes that are in line with our customers' product plans to strengthen their competitiveness.

UMC expects wafer shipments to be approximately 10% lower in the fourth quarter from the previous quarter; capacity utilisation is expected to be 90%; meanwhile, UMC has lowered its 2022 capital expenditure to US$3 billion from the previous US$3.95 billion, but capacity deployment at Nanke Fab 12A's P5 and P6 fabs and Singapore fab continues in response to long-term customer demand.

At the conference, Mr Wang said that there were two main reasons for the downward revision in capital expenditure, namely delays in equipment delivery and a response to the declining economy. However, he also stressed that most of the major customers who have signed LTAs (Long Term Agreements) with UMC are not in default, but admitted: "There are indeed customers who are unable to fulfill their long term contracts."

Despite the recent market turmoil, UMC's long-term outlook remains bullish as the market grows due to the popularity of applications such as 5G, AIoT and electric vehicles, and the increase in semiconductor content. Backed by a sound financial structure and sufficient working capital, UMC is committed to manufacturing excellence and developing a comprehensive range of products, and targeting high-growth markets to strengthen UMC's leading position in special technologies.

How many chips does a car need?

How many chips does a car need?

Position and Function of Main Automotive Sensors

Position and Function of Main Automotive Sensors

Chip: The increasingly intelligent electronic brain

Chip: The increasingly intelligent electronic brain

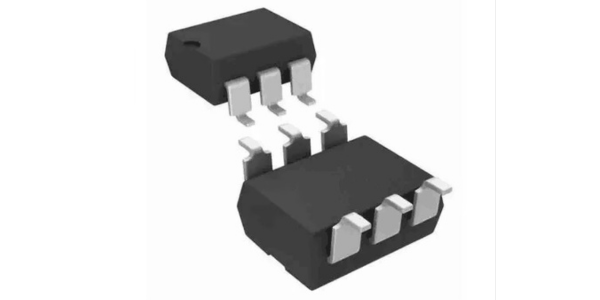

LDA100 Optocoupler: Outstanding Performance, Wide Applications

LDA100 Optocoupler: Outstanding Performance, Wide Applications