How many chips does a car need?

How many chips does a car need?

Sep .19.2024

Automotive chips can be divided into four types according to their functions: control (MCU and AI chips), power, sensors, and others (such as memory). The market is monopolized by international giants. The automotive chips people often talk about refer to

Position and Function of Main Automotive Sensors

Position and Function of Main Automotive Sensors

Sep .18.2024

The function of the air flow sensor is to convert the amount of air inhaled into the engine into an electrical signal and provide it to the electronic control unit (ECU). It is the main basis for determining the basic fuel injection volume. Vane type: The

Chip: The increasingly intelligent electronic brain

Chip: The increasingly intelligent electronic brain

Sep .14.2024

In this era of rapid technological development, we often marvel at how mobile phones can run various application software smoothly, how online classes can be free of lag and achieve zero latency, and how the functions of electronic devices are becoming mo

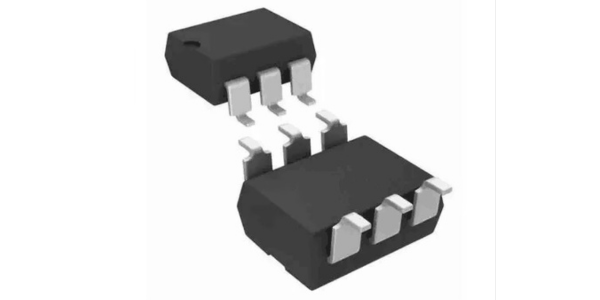

LDA100 Optocoupler: Outstanding Performance, Wide Applications

LDA100 Optocoupler: Outstanding Performance, Wide Applications

Sep .13.2024

In terms of characteristics, LDA100 is outstanding. It offers AC and DC input versions for optional selection, enabling it to work stably in different power supply environments. The small 6-pin DIP package not only saves space but also facilitates install

How many chips does a car need?

How many chips does a car need?

Position and Function of Main Automotive Sensors

Position and Function of Main Automotive Sensors

Chip: The increasingly intelligent electronic brain

Chip: The increasingly intelligent electronic brain

LDA100 Optocoupler: Outstanding Performance, Wide Applications

LDA100 Optocoupler: Outstanding Performance, Wide Applications